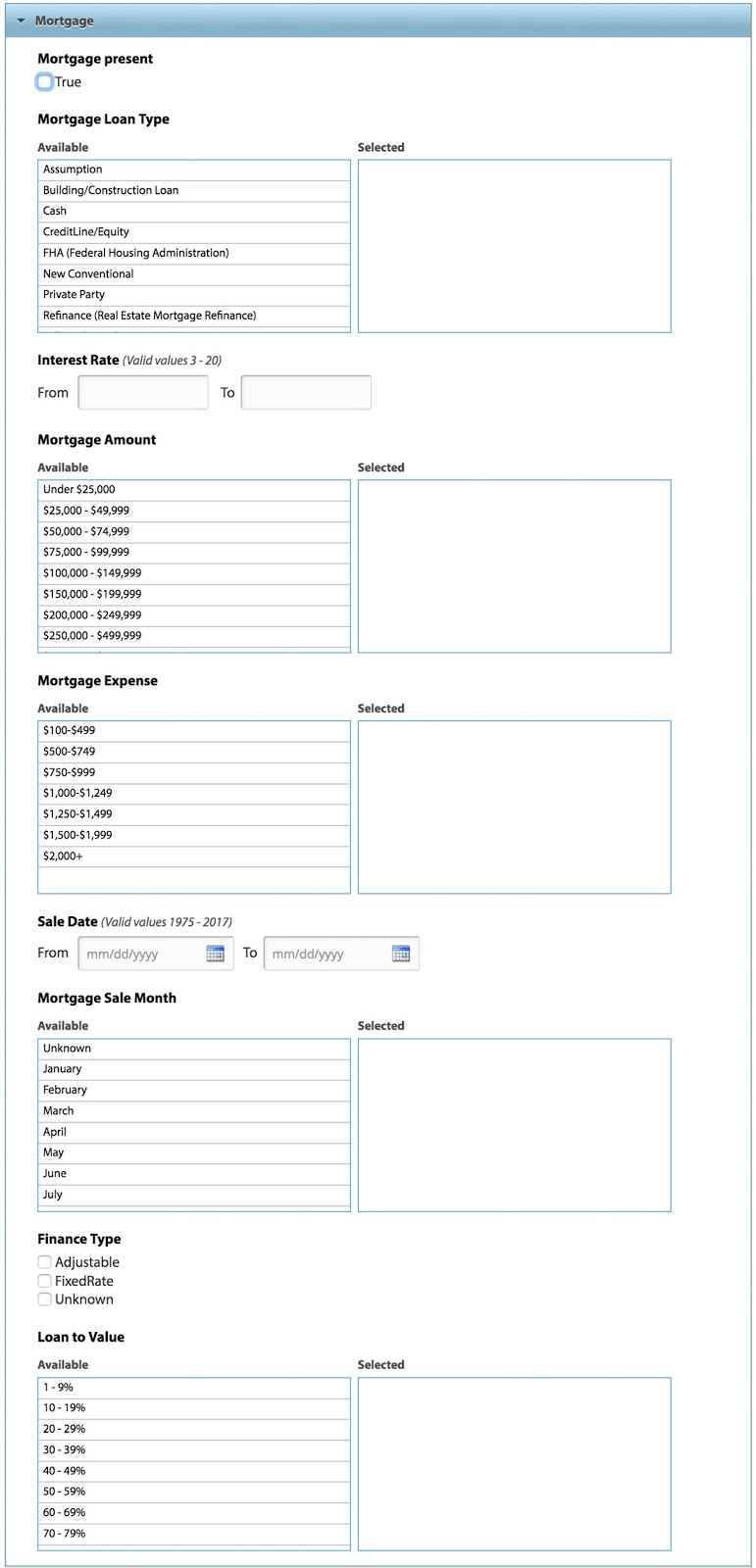

Under the Mortgage header, there are a wide range of Mortgage criteria to choose from to narrow your consumer search:

- Mortgage Present: The simplest selection, check this if you only want to know if there is a mortgage and don’t care about loan type, amount, interest rate or other details.

- Mortgage Loan Type: Click on any of the following standard mortgage types or originators in the “Available” column to move them into the “Selected” column and include them in your search:

- Assumption: Original mortgage assumed by a new owner

- Building/Construction Loan: Mortgage involving a builder

- Cash: No mortgage, home paid for in cash

-

Credit Line/Equity: If a line of equity is backed by the house

FHA (Federal Housing Administration): A federal agency that is a top-issuer of residential mortgages - New Conventional: The primary mortgage

- Private Party: Financing provided by a private party and not a financial institution.

- Refinance (Real Estate Mortgage Refinance): Presence of refinanced mortgage

- Seller Take Back: Typically a second mortgage offered by a seller to help a buyer make the purchase, in addition to the primary mortgage

- Stand Alone Second: An additional mortgage taken out on top of the primary mortgage

- VA (Veteran’s Administration): A federal agency that is a top-issuer of residential mortgages for military veterans.

- Interest Rate: This data is based off the initial purchase as recorded with county registrar of deeds. Where no interest rate information is available at the county or household level, data is modeled. This will not indicate refinancing. Choose a range of interest rates with this options, starting with the lowest rate in the “From” field (minimum of 3) and the highest rate in the “To” field (maximum of 20). To narrow your search to one interest rate, enter that rate in both the “From” and “To” fields.

- Mortgage Amount: A range of estimates of the mortgage amount taken out to purchase the home. Click on Mortgage Amount estimated ranges under the “Available” column in $25,000 increments up to $99,999, then $50,000 increments up to $199,999, and finally $100,000 increments up to $1,000,000+, to put in the “Selected” column.

- Mortgage Expense: A range of estimates for the mortgage expense (monthly payment) paid by the homeowner, excluding real estate taxes and fees. Click on Mortgage Expense estimated ranges in $250 increments from $100-$499 up to $2,000+

- Sale Date: Choose an exact range of sales dates with this options, starting with the oldest date in the “From” field (starting in 1975) and most recent date in the “To” field (current year). To narrow your search to an exact date, enter that rate in both the “From” and “To” fields.

- Mortgage Sale Month: The month the mortgage originated based on the month the home was sold. Click on the months in the “Available” column to place that criteria in the “Selected” column.

- Finance Type: Identify consumers from one of 2 mortgage finance types, signifying the flexibility in the interest rate, either Adjustable or Fixed. A third option lets you choose Unknown.

- Loan to Value: This criteria allows you to choose from a range of Loan to Value (LTV), a percentage measuring the value of the mortgage to the value of the home. A home valued at $100,000 with a $100,000 mortgage would have a 100% LTV. Click on LTV ranges under the “Available” column in 10% increments up to 150%+ to put those ranges in the “Selected” column.